Election campaigns should mainly be about the policies a party would enact, if elected. But they’re also about the things a party wouldn’t do.

When Labour pretended to believe that National wanted to turn the country into some kind of dystopic theocracy, National explicitly ruled out any changes in access to contraception and abortion.

The promise mattered to a lot of people, and promising not to do something you had never intended to do is fairly straightforward.

So why hasn’t Labour ruled out the Green Party’s proposed wealth tax of 2.5% on net wealth above $2 million per person?

From reports around Wellington, Labour’s Revenue Minister David Parker wanted either a wealth tax or a tax on unrealised capital gains. But he just could not quite muster the numbers for it at Cabinet.

That calculus could change if it were part of coalition bargaining. And it would be well worth ruling out in advance.

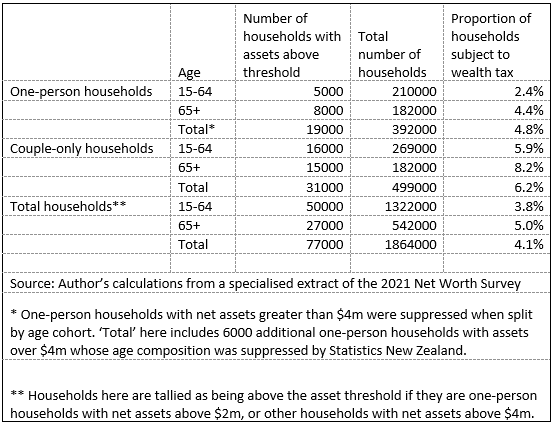

The Green Party suggests that only 0.7% of Kiwis would face their proposed tax. I asked Statistics New Zealand how many households have net assets above the relevant wealth tax thresholds.

The table below, constructed from their response, shows a lot more households would be hit. Over eight percent of retired couples would have to deal with the proposed wealth tax.

Since the table’s figures are from 2021, expect current figures to be higher. And since government does not like inflation-adjusting any of the tax thresholds, I expect the proportion would be a fair bit higher by the time I retire.

But that’s hardly the biggest problem.

Successive Tax Working Groups have argued the merits of taxing realised capital gains in real-world settings. A majority of the 2010 Tax Working Group considered a capital gains tax not to be worth the bother; a strong minority of the 2019 Tax Working Group felt similarly.

But a wealth tax is different. It imposes an exceptionally high effective tax rate on investment by wealthier people and chases that investment away.

Consider someone subject to the 2.5% wealth tax who is in the 39% income tax bracket. That person is considering what to do with their next million dollars. Should they lend a company some money to make investments by buying some bonds? Or should they just leave the country and make investments elsewhere, taking their wealth with them?

And for purposes of this example, imagine that the only thing we care about is whether investments are made. Constitutionality of the proposed tax, its consistency with generally accepted tax principles, and its fairness we will leave to one side. The tax’s proponents seem not terribly bothered by such concerns.

All we here look at are the implications for investment. They are troubling.

If inflation is 2%, then an investment must earn at least 2% in nominal returns just to stand still.

Income tax is due on the nominal returns on that investment including inflation. So the investment has to earn at least 3.3% nominal interest, just to stand still and not lose value due to tax, inflation, and the tax on inflation.

Now add a wealth tax of 2.5% that does not just apply to the earnings on the investment, but rather to the full amount of the investment including inflation.

That investment now has to earn a 7.6% return, just so that the investment can stand still.

We can put it more concretely. If you are already above the wealth tax thresholds, investing your next million dollars at a 7.6% return provides $76,000 in nominal earnings. Income tax, at 39%, takes just under $30,000 from those earnings, leaving you with just over $46,000. A 2.5% wealth tax on the investment at the end of the year takes just over $26,000, leaving you with $20,000. And you needed to earn $20,000 on that million just to keep up with inflation.

Those numbers get worse under the Green Party’s proposed 45% top income tax rate.

If you cannot find investments yielding at least 7.6%, you will be stuck watching the value of your assets slowly decline until you no longer have wealth above the threshold to be taxed.

Interest.co.nz keeps a running tally of corporate bond issues. Inflation right now is much higher than 2% and will mean that nominal yields are higher than they would be if inflation were back to 2%. But no listed bonds have a coupon payment that would let the value of an investment stand still, even if inflation came down to 2%.

What would happen to projects funded by those bonds if investment were hammered by a wealth tax? Some of them would disappear. Or perhaps New Zealand companies would find foreign investors able to avoid New Zealand’s wealth tax.

Even if you think it is perfectly fine to set a tax structure that almost guarantees that wealthier people will have less money at the end of the year than they started with, think about what it does to investment – and to productivity more generally. New Zealand is not a capital rich country. A whole lot of investment is needed. Adding capital to businesses makes workers more productive and helps increase wages. Chasing capital away does the opposite.

The safest advice for anyone with a lot of moveable assets likely to be subject to this kind of wealth tax: flee the country before the tax is imposed.

Economists and tax experts will at least debate the merits of capital gains taxes. They’ll even often support land taxes, with caveats around delineation of central government and local government rating bases. Land does not move. Capital and financial wealth does.

Broad wealth taxes of the sort proposed cannot help but have pernicious effects on investment. And if accountants cannot find ways around the tax for wealthier clients, it would encourage out-migration of the country’s wealthiest.

Labour really ought to rule out a wealth tax.